What goes into whole life insurance dividends?

By: Allen Wastler | Mass Mutual

Beyond protection and the ability to build cash value, many whole life insurance policies typically offer a particular feature that many policyowners find attractive: dividends.

But this feature, while sounding simple, actually involves some complexity and comes with caveats. So, it’s important to understand the ins and outs of dividends in order to appreciate the overall benefit a whole life insurance policy may mean for you.

First and foremost, dividends aren’t guaranteed. The amount of the overall dividend and the individual dividend payouts are subject to change, depending on the operating experience of the insurance carrier in a given year. Generally, it’s a case of when the insurance company does well in a certain year, its policyowners get a share of its divisible surplus.

Second, the policy has to be “participating,” that is, a type of insurance or other financial product that has been designated by the insurance company as eligible to receive dividends.

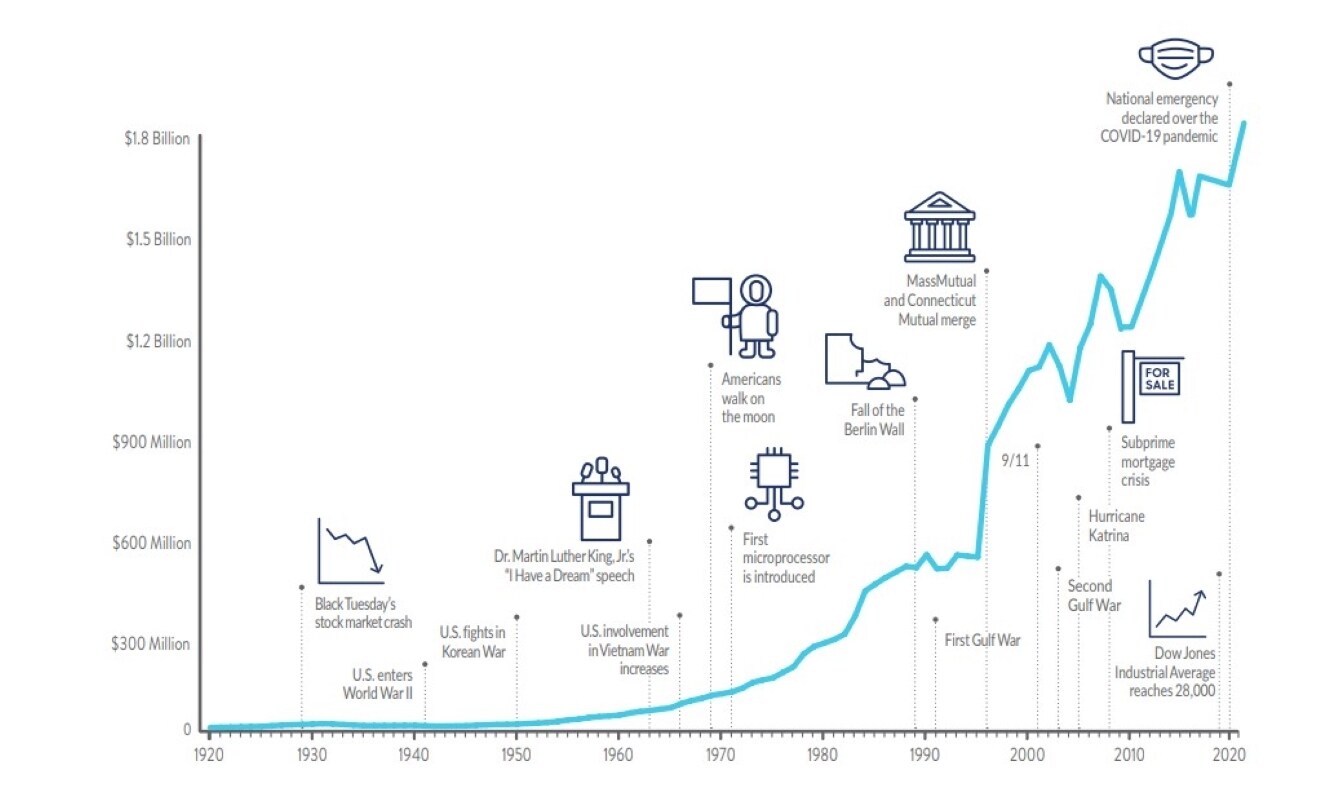

Although dividends are not guaranteed, most insurance carriers strive to pay them consistently to eligible participating whole life policyowners. MassMutual, for instance, has paid out dividends consistently since shortly after the Civil War. And, as the company has grown, the overall amount of that annual dividend payout has grown as well, as noted in the following chart.

So, how are dividends paid out by a mutual insurance company determined each year?

In general, insurance companies take in money through premiums from policy owners. They are required by law to keep a certain amount of that money in reserve to cover their long-term commitments to policy owners. Insurance companies generally invest these reserves in very conservative assets like high-grade bonds and commercial mortgages.

Each year, an insurance carrier calculates the amount of its surplus to set aside to be distributed to eligible participating policy owners as dividends. This is called divisible surplus. This is the amount paid out after the carrier has set aside the funds required to meet all contractual obligations, particularly reserve requirements for its policies, as well as what it expects for operating expenses, contingencies, and general business purposes.

Generally, the divisible surplus primarily comes from three sources:

A mortality (death claims) component

expenses

investment results

Dividends are declared and paid annually. However, because a company cannot guarantee that divisible surplus will be achieved each year, the payment of dividends cannot be guaranteed. It depends on the company’s performance in these three areas.

mortality

The mortality component is based on the actual death claims experience compared with what the insurance company estimated when it issued policies and priced premiums.

Performance in this area reflects how well an insurance company calculates and selects risk in its underwriting operations. A company that is careful about who it agrees to issue life insurance for and how to price the premiums for the policy is likely to have a more positive mortality experience over time. So, at the policy level, the mortality component of the dividend in any year is based on the age, gender, and underwriting class of the insured (their health and habits, like smoking), as well as the net amount of life insurance (face amount less the cash value) in that year. (Related: How a personal health record can lower your costs)

Expenses

Additionally, an insurance company, like any other business entity, will incur expenses to operate, from administration costs to investment fees to salaries. As mentioned above, a company will price premiums with those costs in mind and set aside funds to cover them.

The expense component of the dividend reflects the difference between the actual expenses that were incurred in issuing and administering policies over time as compared with the expenses that were assumed in setting the premiums.

A spike in costs or a decline in efficiency, therefore, will also subtract from the overall surplus. That’s why those considering a whole life insurance policy may want to research an insurance carrier’s corporate performance over time, to see how well it has controlled costs over time. (Related: MassMutual’s financial strength)

investment

The third major element in determining dividends is investment performance. It is based on actual investment results for an insurance carrier that are more favorable than what is required to support policy reserves and guaranteed cash values.

When determining the premiums and guaranteed elements of an eligible participating whole life policy, insurers use conservative assumptions (guaranteed interest rates and mortality rates) to ensure that the company collects enough money to pay all benefits in the future, even under adverse financial scenarios. Favorable investment results occur when the company’s actual investment returns exceed the guaranteed interest rates required to meet its contractual obligations to policyowners.

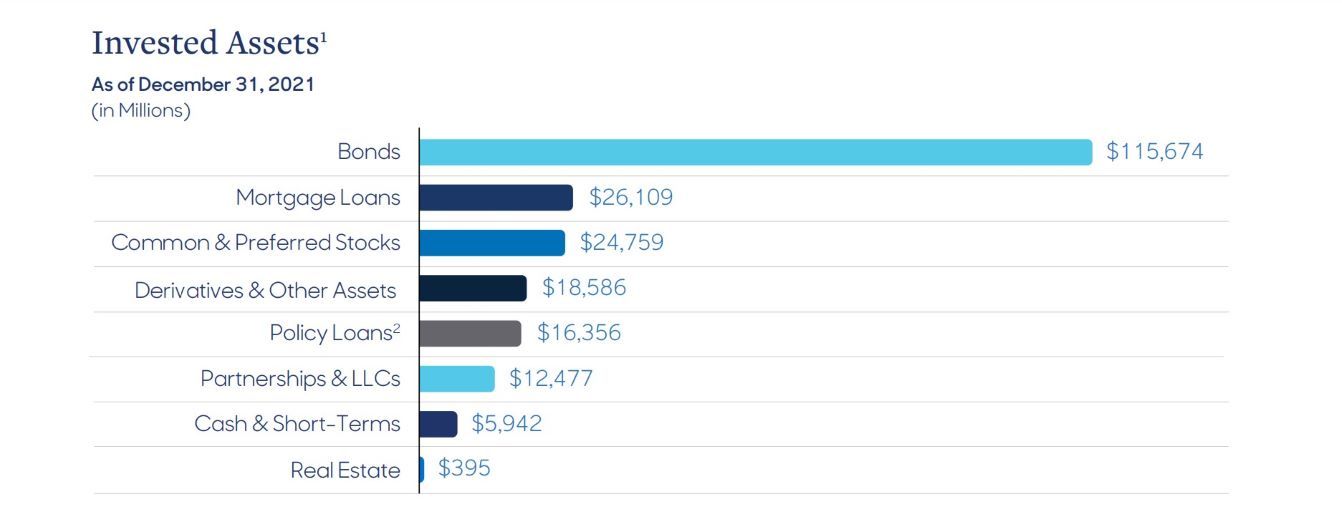

This rests in large part on the carrier’s financial portfolio, which is typically made up of bonds, stocks, and other types of market-based investments.

This is why it’s important for those shopping for whole life insurance to examine an insurance carrier’s holdings and investment philosophy, especially with regard to risk and stability. For instance, MassMutual’s investment goal is to generate competitive long-term results while maintaining the ability to weather downturns in financial markets.

The chart below is a snapshot of MassMutual’s holdings, which consist primarily of high-quality fixed-income securities, but also invest in equities, commercial mortgages, real estate, and other assets.

Other business earnings

Beyond financial instruments, an insurance carrier can also achieve returns by investing in related business lines, third-party businesses, and other enterprises. Profits from those types of investments and operations can also add to a company’s overall surplus.

For instance, MassMutual offers a variety of insurance products beyond whole life insurance, such as annuities. Revenues from those areas help add to its surplus. And MassMutual has ownership stakes in global asset management companies and wealth management operations, which entitle it to a share of the profits those outfits produce.

These kinds of business lines and investments not only can directly add to a company’s surplus, but they can also diversify sources of income. That can soften the blow of a downturn in other types of investments or businesses.

The overall returns from the investment portfolio and other business earnings help support a company’s dividend interest rate (DIR)3, which is set by a company’s board of directors each year. The investment component of the dividend is the difference between the DIR and the policy’s guaranteed interest rate. So, hypothetically, if that guaranteed rate is 4 percent, and the investment component adds up to 2 percent, then the overall DIR will add up to 6 percent.

Comparing dividends and other returns

When you create a trust and place assets into it, such as your home, those assets become the legal property of the trust. As a result, when you die, those assets don’t have to go through a probate court proceeding. Instead, the successor trustee of your trust distributes the assets within it according to your wishes. The process is designed to be quick, inexpensive, and private, though there may still be accountant and attorney fees to settle the estate and the process may still take a few months.

Living trusts are also called “revocable trusts” or “revocable living trusts” because you can change them or dissolve them during your lifetime. You can sell or remove trust assets, you can add new assets, and you can change the beneficiaries, for example. (Related: Setting up a trust)

There are other reasons to create a living trust in your estate planning besides avoiding probate. Placing assets in a trust lets you name someone, your successor trustee, to manage your assets while you’re still alive if you become unable to. You can’t accomplish this with a will. But if you have minor children, you’ll still need a will to name their guardians. You’ll also need a will to distribute assets that aren’t held in trust, such as personal possessions.

“To drive home the importance of estate planning, I often ask my clients with children if they have ever met the local probate judge,” said John P. Farrell, an estate planning attorney with the Farrell Law Firm in Marietta, Georgia. “Of course, they say no, and then I remind them that the local probate judge will be the person who decides who raises their children if they don’t name a guardian for their children through a will.” (Related: Wealth management: Is setting up a trust right for you?)

Who gets a dividend?

As mentioned at the outset, those who purchase eligible participating whole life insurance policies are eligible to receive a dividend. The size of each individual policy owner’s payout depends on how much their policy has contributed to the company’s divisible surplus. So long-standing policies with large death benefits will generally receive larger dividend payouts than smaller policies put in place more recently.

Policy owners can receive dividends in cash, or use them to:

Reduce the following year’s premium payment

Leave on deposit to accumulate with interest

Purchase paid-up additional whole life insurance

Many policyowners go with the last option, which can increase the policy’s death benefit and cash value.

Conclusion

Dividends are an important part of the overall value that participating whole life insurance offers. But it’s important to know how dividends are determined and what may or may not affect their issuance and payment level.

Since 1851, MassMutual has been focused on helping people secure their financial future and protect the ones they love. That mission is why we have over 7,500 financial professionals to assist you on your journey through insurance, investing, retirement planning, estate management, and more.