Committed to your financial success and security

Live the life you want to live and leave the life you want to leave

Live the life you want to live and leave the life you want to leave

Aligning Your Finances with Purpose

At Sentinel Solutions, we understand that managing your personal and family wealth involves an intricate set of challenges. This is why we’ve developed a suite of services tailored to help you navigate through the complex world of financial management. Our holistic approach includes risk management, tax strategies, investment solutions, and estate and asset protection. We are experts at listening, planning, and designing strategies that surpass your goals.

Remember, your financial success isn’t just about numbers, it’s about aligning your financial resources with your values, ambitions, and life’s purpose.

Let us be your sentinel.

Investment Management

Our dedicated team of experts applies a personalized, strategic approach to your investment portfolio. We understand the importance of balancing risk with reward and aligning your investments with your unique financial objectives. Our approach is not about chasing market trends, but about implementing a plan that adapts to market changes while staying true to your financial goals.

Estate Planning

Preserving your legacy and facilitating the seamless transfer of wealth to future generations demands meticulous planning. Our team of estate planning professionals specializes in gift planning, trust planning, and estate planning. We’ll navigate the complexities of wills, trusts, and estate tax considerations hand in hand with you. Collaboratively, we’ll develop a comprehensive plan that aligns with your wishes, safeguards your assets, minimizes tax implications, and enables you to create a lasting legacy for your cherished ones.

For founders and business owners who will ultimately sell or transfer their private business, we are experts in exit strategies including section 1202 Qualified Small Business Stock.

Risk Management

Life is unpredictable, and risk is an inevitable part of the financial landscape. Our risk management strategies aim to safeguard your wealth and secure your financial future against potential threats. We undertake a rigorous risk assessment of your financial landscape, considering all aspects from market volatility to personal liability and beyond. This allows us to design a bespoke risk management strategy that suits your specific situation.

Retirement Planning

We specialize in designing customized retirement strategies that ensure your golden years are filled with peace of mind and financial security. Our team will assess your current situation, project future income needs, and help you make informed decisions about savings, investments, and pension plans. With our guidance, you can retire comfortably and enjoy a life of Saturdays.

Vision-Crafting™

This first step of our process is to listen and learn about your vision, values, and goals.

This unique workshop provides the format for crafting your Personal Life Vision for today, tomorrow and for your legacy.

No sales pitches. No lectures. No unsolicited opinions.

Impact Lab™

Our team of subject matter experts conduct a thorough analysis of your entire financial landscape – personal and professional. Employing expertise and advanced technology, we assemble your Impact Horizon to measure and verify.

This unique organizational structure projects your future outlook taking into consideration risk and tax implications for the success of your financial vision. This tool measures potential outcomes using various assumptions strategies, and solutions.

Impact Workshop™

We verify your data and share a comprehensive list of issues and obstacles our team of subject matter experts have identified in your current plan to achieve your desired outcome.

This is a collaborative meeting where we explore your best options and strategies together, and determine the optimal approach for your needs. If we agree, we move forward.

The Action Accelerator

The execution of your selected plans begins with Step Four. We walk through the implementation elements of each strategy.

The Momentum Advocate

Maintaining momentum requires encouragement, regular updates, and guidance. We schedule periodic reviews to assess progress and remain in alignment with your priorities.

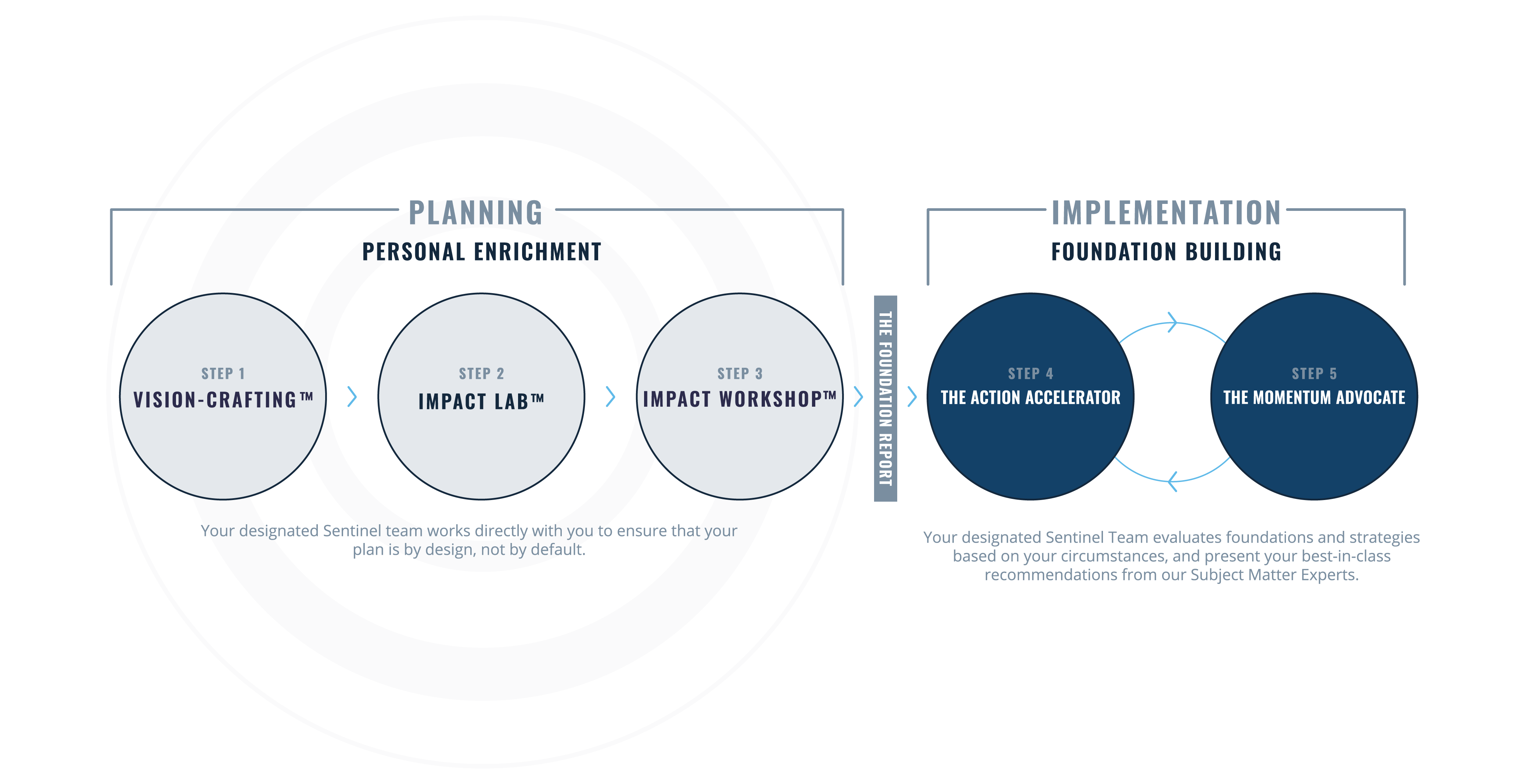

PLANNING

PERSONAL ENRICHMENT

Your designated Sentinel team works directly with you to ensure that your plan is by design, not by default.

STEP 1: Vision-Crafting™

This first step of our process is to listen and learn about your vision, values, and goals.

This unique workshop provides the format for crafting your Personal Life Vision for today, tomorrow and for your legacy.

No sales pitches. No lectures. No unsolicited opinions.

STEP 2: Impact Lab™

Our team of subject matter experts conduct a thorough analysis of your entire financial landscape – personal and professional. Employing expertise and advanced technology, we assemble your Impact Horizon to measure and verify.

This unique organizational structure projects your future outlook taking into consideration risk and tax implications for the success of your financial vision. This tool measures potential outcomes using various assumptions strategies, and solutions.

STEP 3: Impact Workshop™

We verify your data and share a comprehensive list of issues and obstacles our team of subject matter experts have identified in your current plan to achieve your desired outcome.

This is a collaborative meeting where we explore your best options and strategies together, and determine the optimal approach for your needs. If we agree, we move forward.

IMPLEMENTATION

FOUNDATION BUILDING

Your designated Sentinel team evaluates foundations and strategies based on your circumstances, and present your best-in-class recommendations from our Subject Matter Experts.

STEP 4: The Action Accelerator

The execution of your selected plans begins with Step Four. We walk through the implementation elements of each strategy.

STEP 5: The Momentum Advocate

Maintaining momentum requires encouragement, regular updates, and guidance. We schedule periodic reviews to assess progress and remain in alignment with your priorities.

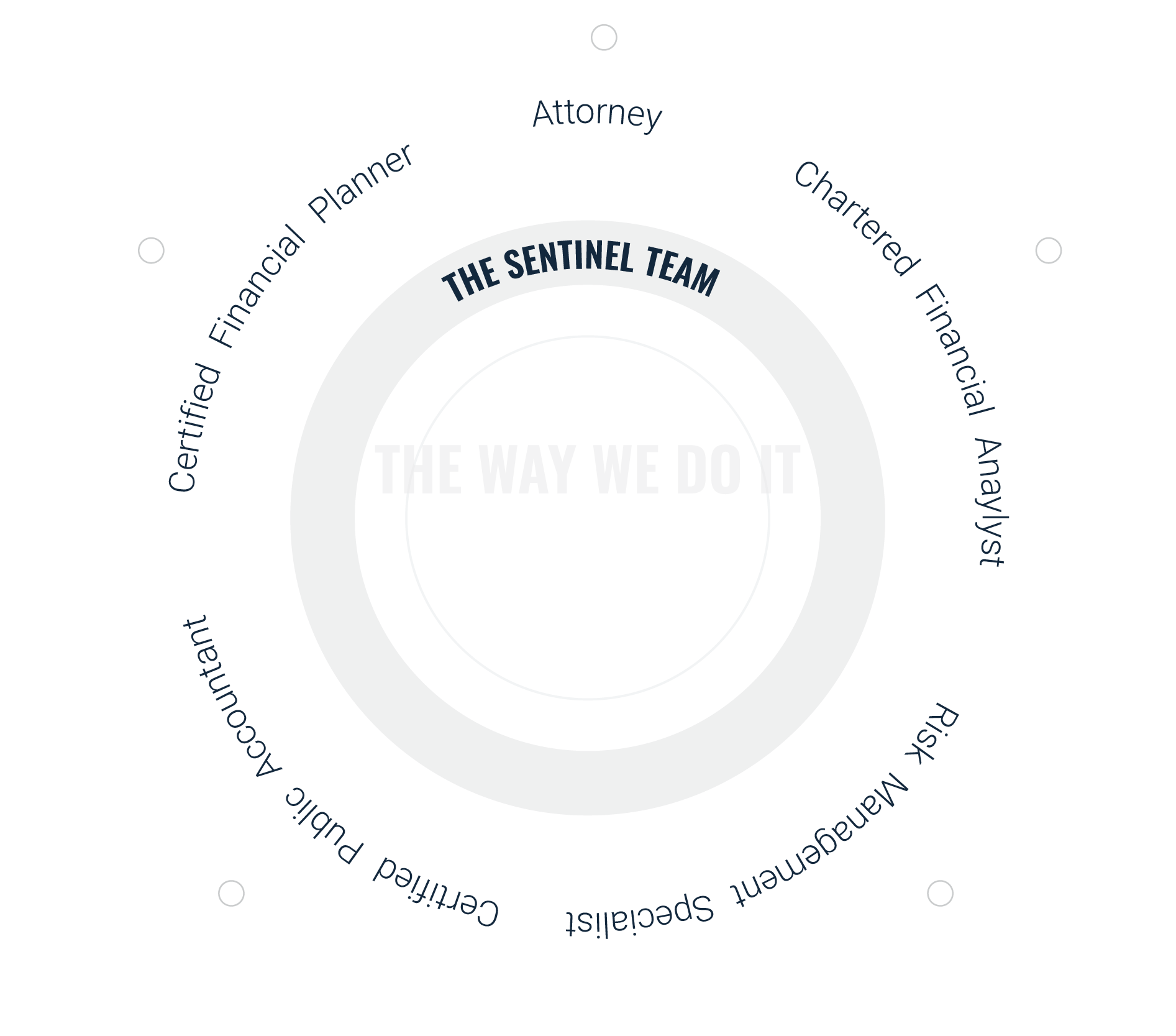

When was the last time your team of advisors met on your behalf to ensure coordination of your plan?

Risk Management

Life Insurance

For countless families, life insurance isn’t just a financial product; it’s the cornerstone of their financial security. And it’s not hard to understand why. Can you picture the daunting financial hurdles your family might confront if you or your spouse were no longer there to provide support?

The importance of selecting the right type of life insurance coverage cannot be overstated. It goes beyond just protecting your loved ones; it’s about maintaining a sense of normalcy and security, even in the face of life’s most challenging moments. Additionally, there are life insurance policies available that offer not only protection but also the opportunity to build cash value for long-term goals such as your retirement or your children’s education.

Annuities

Disability Income Insurance

Has your family’s financial security ever crossed your mind if you were to face a sudden illness or accident that renders you unable to work? Life insurance is invaluable for families after the loss of a breadwinner, but what about situations when that breadwinner is alive yet unable to work?

Long-term disability insurance steps in to provide vital support for you and your family during times of incapacitation. Depending on the specific policy you select, you could receive benefits that cover a portion or the entirety of your salary, along with potential bonuses, stock options, and additional compensation. Our expertise can guide you through the available options, helping you choose the one that complements any existing benefits from your employer.

Here’s another important point to consider: If you’re fortunate enough to have an employer offering a long-term disability plan, it’s crucial to understand the extent of coverage it provides during periods of unemployment. However, if you find yourself either undercovered or self-employed, owning a personal disability policy could be a wise move to ensure your financial well-being in challenging times.

Long-Term Care Insurance

It’s difficult to imagine that one day our loved ones may require assistance with their day-to-day tasks. Whether it’s long-term care in a nursing home, assisted living facility, or through a home care service, the costs associated with this care can soar into the thousands of dollars each month.

To address these substantial costs, many individuals have made the thoughtful choice to invest in long-term care insurance. These policies offer specific benefits for designated periods of time. While they may not be the most budget-friendly option, they have played a vital role in assisting countless families in caring for their aging parents and relatives. Importantly, they also serve as a means of safeguarding the assets individuals have worked tirelessly to accumulate over a lifetime—assets they aspire to pass on to their cherished loved ones.

Property & Casualty Insurance

Is your insurance coverage aligned with your needs and budget?

When it comes to property and casualty insurance, it’s not just about choosing deductibles and liability limits; it’s about tailoring your policy to suit your unique requirements. Each option you select not only impacts the protection you receive but also influences the cost of your coverage. At Sentinel, we undergo a comprehensive evaluation of your existing coverage to uncover any potential gaps and ensure that you’re not only adequately protected but also at a reasonable cost.

Our property and casualty solutions extend far beyond the basics of car and home insurance. We take a holistic approach, encompassing all your valuable assets. Your peace of mind and financial security are our top priorities.

LET US BE YOUR SENTINEL

The Sentinel Approach

We take a holistic approach to wealth management.

Our job is to help ensure that your plan is by design, not by default. Sentinel’s team of subject matter experts will work with you to craft a vision of your future and develop a plan to get you there. We will be there every step of the way, working to protect, save, grow, keep, and deliver your finances to the people and causes you care about.